by | Aug 9, 2023 | Tax Tips and News

Is contactless tax preparation the future of the industry?

While the 2020 filing season jettisoned the tax industry into a virtual arena, the 2023 season seems to indicate that contactless tax preparation has some staying power as tax professionals continue to adapt to the needs and preferences of their clients.

Drake Software has been keeping an eye on the contactless prep trend through a yearly survey of tax professionals. More than 900 participants from tax offices around the nation (including attorneys, CPAs, EAs, and preparers) shared their preferences and insight in the 2023 Contactless Tax Preparation survey.

Participants answered more than 20 questions addressing topics such as the following:

- Client interest in no-contact, completely virtual preparation

- Client-facing portal systems

- The number of returns prepared with no in-office contact

- Preparer interest in providing contactless services post-pandemic

For the results, download the Drake Software 2022 Contactless Tax Preparation Infographic.

– Story provided by TaxingSubjects.com

by | Aug 6, 2023 | Tax Tips and News

Summer events for the tax industry are in full swing as professionals from around the country gather to share resources, insight, software, and tools for the 2024 filing season.

The Drake Software team has enjoyed the time on the road and the opportunities to meet users, demonstrate our tax prep solutions, and share industry expertise.

Engaging with the Drake Software Team

Attending IRS Nationwide Tax Forums and trade shows provides an excellent opportunity to interact with the Drake Software team directly. Our representatives will be available at the Drake Software booth to answer your questions, provide personalized solutions, and guide you through the process of making the most of your tax software.

Hands-on Demonstrations

One of the key highlights of Drake Software’s presence at these events is the opportunity to witness live, hands-on demonstrations of our cutting-edge tax software. Attendees will get a chance to explore the features that make Drake Software an industry favorite, such as its user-friendly interface, advanced tax preparation tools, and efficient e-filing capabilities. Tax professionals can gain insights into optimizing their workflows and enhancing their tax preparation efficiency.

Exclusive Workshops and Training Sessions

To maximize the benefits of participating in IRS Tax Forums and other events, Drake Software is organizing exclusive workshops and training sessions for attendees. These sessions are conducted by our seasoned experts, offering valuable insights into leveraging the software’s capabilities effectively.

Among the standout sessions are John Sapp’s presentation on “Protecting Taxpayer Data from Cybercriminals” at AICPA, Ann Cambell and Christine Reynolds’ Lunch and Learn session on DSUE at the NAEA Convention, and Jared Ballew’s talk on Written Information Security Plans (WISP) at the IRS Tax Forums. Whether you’re a seasoned tax professional or just starting in the field, these training sessions will help you gain a competitive edge and boost your tax preparation skills.

More opportunities to meet Drake Software on the road

IRS Nationwide Tax Forums and other trade shows serve as an excellent platform for tax professionals to come together, share knowledge, learn from industry experts, and exchange ideas.

For more opportunities to meet with us in person, visit our Trade Shows page.

We look forward to building even more meaningful connections within the tax industry!

– Story provided by TaxingSubjects.com

by | Aug 6, 2023 | Tax Tips and News

The Internal Revenue Service says it has constructed a blueprint for its future called the Paperless Processing Initiative. The plans are aimed at eliminating up to 200 million pieces of paper every year, while cutting processing times in half and speeding up refunds by weeks. The agency says it will realize these benefits by fully embracing digital filing and processing – the sooner, the better. The plan is a two-step process with work starting now and extending past filing season 2026. It’s funded by the Inflation Reduction Act.

When it comes to speeding up the taxpaying process, paper is the enemy.

Every year, the IRS gets about 76 million paper tax returns and forms, and another 125 million pieces of correspondence. Each one of those pieces of paper requires a human being to enter its information into the IRS computer systems.

This process can lead to a filing logjam as outside of the annual 1040 tax return and a relatively few other forms, taxpayers are currently limited to sending in forms and correspondence to the IRS on paper. Meanwhile, the agency can’t digitally process the mountain of paper it gets. In fact, just storing the paper returns and correspondence the agency receives costs a tidy $40 million every year. The plan is to push all tax filing into the digital world, and to devise a system to automatically scan any paper documents on arrival.

Step One: Taxpayers Can Go Paperless in Filing Season 2024

The first step is a big one in itself: taxpayers will be able to send all their correspondence, non-tax forms, and notice responses to the IRS in digital form. This may appear to be a small action, but it will take millions of paper documents out of the processing backlog every year. The IRS estimates that this initial step alone will mean some 94% of individual taxpayers will no longer ever need to send a piece of mail to the agency.

Some 20 additional tax forms, meanwhile, will be added to the digital availability list. This will include amendments to Forms 940, 941, and 941SSPR. The most popular non-tax forms – at least 20 of them – will also be moved over into the digital world and optimized for mobile devices. This includes the Request for Taxpayer Advocate Service Assistance.

Note, however, that in this first phase taxpayers who have a need to file a paper form or send paper correspondence may still do so.

Step Two: IRS Starts Paperless Processing for Tax Returns in Filing Season 2025.

In this phase, the IRS takes aim at the avalanche of paper it receives, whether tax forms or correspondence.

The agency timeline calls for all paper-filed tax and information returns to be digitally processed on arrival. Half of all non-tax forms, notice responses and other correspondence should start being digitally processed by this period, with full digital processing in place in a year’s time. Once in place, digital processing will also enable up to a billion historical documents – filed tax returns and other files – to be digitized, freeing up millions of dollars in storage costs.

Also, in this step, an additional 150 of the most-used non-tax forms will be available in digital form and optimized for mobile devices. This reflects the move by the IRS to make more of the most popular forms available for smartphones as the they estimate that some 15% of Americans rely on their phones for main internet access, and do not have broadband at home.

IRS: Digital Processing Key to Agency’s Future.

The benefits of paperless processing are huge. First, it stands to speed up customer service by making filed returns and other information available digitally, reducing the possibility of human error in data entry as well as granting customer service representatives improved access to information for addressing taxpayer questions. Taxpayers could expect to see their refunds sooner, since all the data and tax forms will be processed faster. Finally, successful implementation could also have financial rewards from lower paper storage costs, which can be leveraged into other technical improvements within the IRS.

– Story provided by TaxingSubjects.com

by | Jul 19, 2023 | Tax Tips and News

A key Internal Revenue Service advisory committee has issued its recommendations for 2023, in an effort to keep the IRS – and Congress – on point with improvements to the nation’s income tax filing system.

The Electronic Tax Administration Advisory Committee (ETAAC) is chaired by Jared Ballew, Vice President of Government Relations at Taxwell Representing Drake Software and TaxAct. ETAAC’s just-released annual report carries 26 recommendations aimed at improving electronic tax filing.

Of the 26 items on the committee’s action list, 21 are aimed at the IRS, three are addressed to both the IRS and Congress, and two are meant for Congress.

Some of the 2023 recommendations have their roots in previous ETAAC reports, such as the appeals to Congress to provide timely tax legislation and to pass consistent funding packages for IRS operations and administration.

Other recommendations, meanwhile, look to the future, asking the IRS to make modernization of their processes and equipment a priority, along with improving its online search engines.

Some of the remaining recommendations include:

- Making the IRS’ expansion of the Online Account toolset a priority.

- Prioritizing e-filing of 94X returns and improving processing of duplicate 94X returns.

- Updating Form 1099-K (and its education materials) to allow for easy compliance.

- Making tax information documents available digitally in real-time, so taxpayers can easily export tax data into third-party software.

- Speeding up processing of returns, whether electronically filed or paper.

- Asking the IRS and Congress to do more to regulate paid tax preparers and take steps in the areas of incompetent or unscrupulous conduct.

- Stressing the IRS should come up with ways to deal with higher attrition of its workforce and increasing demands for customer service.

- Asking the IRS to provide timely guidance on federal and state laws that can have an impact on tax administration.

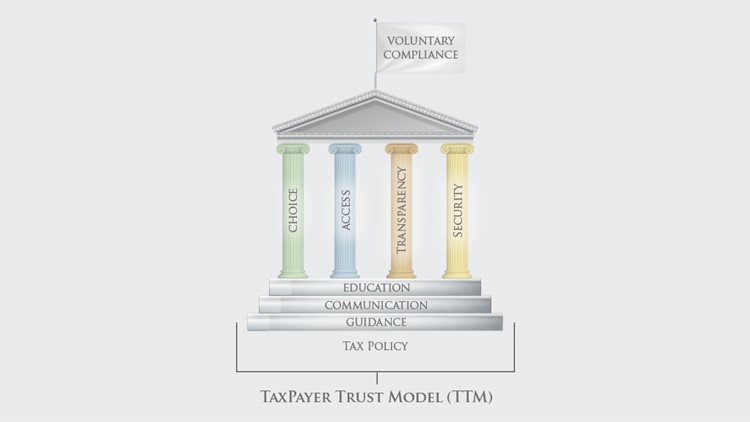

An introductory letter in ETAAC’s 84-page Report to Congress says the committee worked hard to present a report that was balanced yet comprehensive. It uses what the committee calls “the taxpayer’s journey” to describe the various facets of the income tax process. ETAAC also developed a new model to aid in decision-making processes for both policymakers and tax administrators.

“ETAAC has established the Taxpayer Trust Model (TTM) in an effort to standardize, build and maintain high levels of trust in the tax system and to increase compliance. We believe the TTM framework can serve legislators, tax administrators, and stakeholders in their decision-making processes.”

The report also notes that a number of recommendations made in the committee’s previous 2022 report remain unrealized and are still in need of action from the IRS as well as Congress.

The members of ETAAC come from sectors throughout the tax community, representing individual and business taxpayers, tax professionals and preparers, tax software developers, providers of payroll services, the financial industry and state and local governments.

The committee frequently works with the Security Summit, which is a panel made up of IRS officials, state taxing agency representatives and tax industry partners all working together to fight tax-related identity theft and other cybercrimes.

– Story provided by TaxingSubjects.com

by | Jun 12, 2023 | Tax Tips and News

Weeks of record flooding and mountain snows brought on by an “atmospheric river” in California resulted in a federal disaster declaration from the Federal Emergency Management Agency (FEMA). While disaster victims received tax relief from filing and payment deadlines, some were confused after receiving notices from the Internal Revenue Service.

Why are California disaster victims confused?

When taxpayers fail to pay federal tax due by the deadline, the IRS is required by law to generate a Notice CP14 mailout telling recipients they have 21 days to resolve their balance. Some California disaster victims were reportedly confused after receiving the notice, believing they had additional time to file returns and pay any tax due.

(Spoiler: they do.)

While disaster victims did receive Notice CP14, the IRS noted in a recent statement that the mailings also included a special insert reminding these taxpayers that the previously issued tax relief still applies. However, the agency apologized for the confusion, stressing that storm victims who received the Notice do not need to contact the IRS or their trusted tax professional.

How can I learn more about IRS notices and installment arrangements?

DrakeCPE provides courses covering a variety of tax topics, including two that can help tax professionals better serve clients who have received IRS notices or are unable to pay all taxes owed in one lump sum:

For information about available courses, visit DrakeCPE.com.

Source: IRS statement on California mailing of balance due notices

– Story provided by TaxingSubjects.com

![2023 Contactless Tax Preparation [Infographic]](https://phyphar.com/wp-content/uploads/2023/08/2023-contactless-tax-preparation-infographic.png)