Tax Blog

Tips to help you prepare for tax season

2023 Dirty Dozen: Ineligible Employee Retention Credit Claims

Identity theft usually takes center stage during most tax-scam discussions. After all, so much of our personal and professional lives take place online in emails, texts, and direct messages—all of which are ripe targets for phishing attacks. However, not all identity threats are limited to inboxes.… Read more about 2023 Dirty Dozen: Ineligible Employee Retention Credit Claims (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

IRS Digital Intake Initiative Underway

Paper returns have historically been slower to process due to the Internal Revenue Service having to manually transcribe information, leading taxpayers who want to more quickly receive their refund to electronically file. However, there could be a light at the end of the tunnel for those who either prefer or are required to file paper returns.… Read more about IRS Digital Intake Initiative Underway (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

SCOTUS Rules FBAR Penalty Determined on Per-Report Basis

Taxpayers with foreign bank accounts who forgot to file an annual Report of Foreign Bank and Financial Accounts (FBAR) received some good news at the end of February. In Bittner v. United States, the Supreme Court ruled that the penalty for nonwillful failure to file an FBAR should be assessed on a per-report basis—capping fines at $10,000 per year, regardless of the number of accounts.… Read more about SCOTUS Rules FBAR Penalty Determined on Per-Report Basis (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

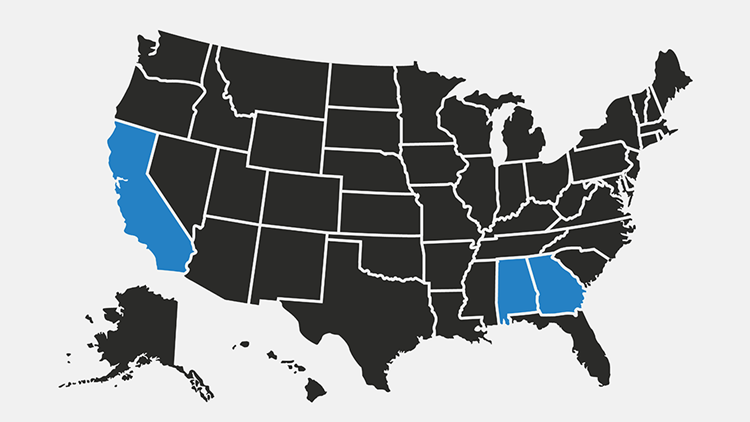

Tax Relief Extended for Disaster Victims in Alabama, California, and Georgia

The Internal Revenue Service recently extended tax relief for disaster victims in Alabama, California, and Georgia. Individuals and businesses in these federally declared disaster areas now have until October 16, 2023, to meet several filing and payment deadlines.… Read more about Tax Relief Extended for Disaster Victims in Alabama, California, and Georgia (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

SCOTUS Holds FBAR Penalty Determined on Per-Report Basis

Taxpayers with foreign bank accounts who forgot to file an annual Report of Foreign Bank and Financial Accounts (FBAR) received some good news at the end of February. In Bittner v. United States, the Supreme Court held that the penalty for nonwillful failure to file an FBAR should be assessed on a per-report basis—capping fines at $10,000 per year, regardless of the number of accounts.… Read more about SCOTUS Holds FBAR Penalty Determined on Per-Report Basis (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

IRS Announces Direct Deposit for Amended Returns

Filing an amended return used to mean completing a paper form, regardless of how taxpayers submitted the original return to the Internal Revenue Service. During the pandemic, paper-filed returns… Read more about IRS Announces Direct Deposit for Amended Returns (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…